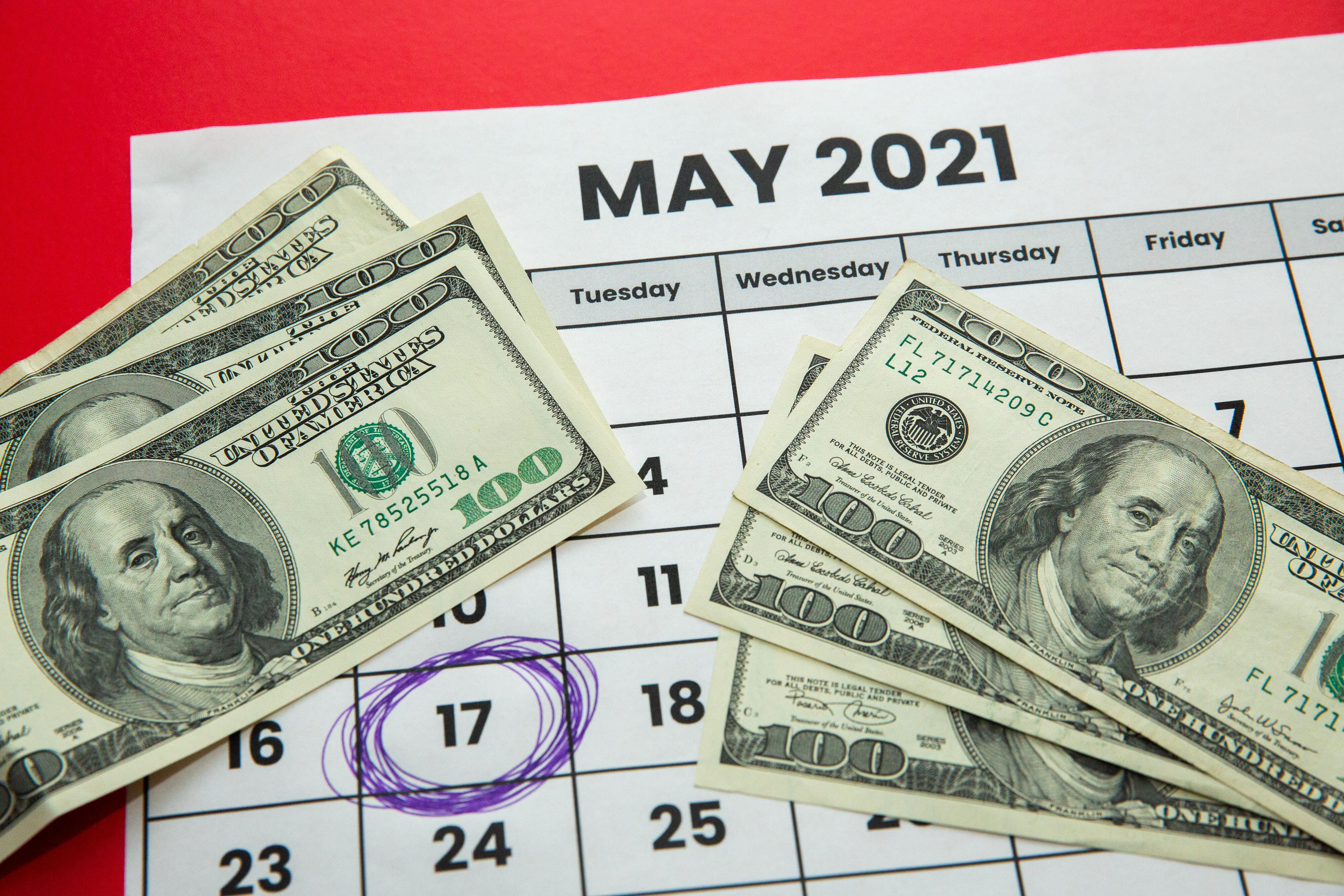

If you miss the May 17 tax filing deadline, you're delaying more than just your tax refund.

Sarah Tew/CNETIf you're waiting until the very last minute to file your 2020 income tax return, you could be putting off some extra money owed to you. This year, meeting the May 17 deadline can help you get the correct amount of your advance child tax credit . It can also help you get a "plus-up" payment if the IRS underestimated the amount of your third stimulus check.

Your 2020 tax information is critical for the IRS to determine how much money you'll receive in 2021. We'll give you four reasons why filing your tax return is a good idea, as well as how filing a tax extension could affect you. If you've already filed your 2020 tax return but haven't received your refund, here's how to track it.

If you received unemployment benefits in 2020, you could be due for a tax break. You might also want to know why that IRS letter on your third stimulus payment is important, how your tax return could give you up to $50,000 in credits and benefits and how to see if the IRS is holding a tax refund you need to claim by May 17. This story is updated frequently.

Reason No. 1: Getting your advance child tax credit amount

The first payment as part of the expanded child tax credit is expected go out in July, and you may be eligible to receive up to $3,600 over seven payments if you and your family qualify. To determine how much money you'll actually get, the IRS needs to know your adjusted gross income. That's why it's important to file your 2020 taxes by May 17 so the IRS is using your most recent tax figures when it calculates your payments. Otherwise, your payment may be smaller than you are eligible for.

The IRS said qualifying families will have another opportunity to update changes to income, filing status and the number of qualifying children, with more information, but didn't provide specifics on how or when. We've reached out to IRS for details on how families will be able to inform the agency of changes.

Reason No. 2: Getting your plus-up stimulus payment

If you've received your third stimulus check you may be due a plus-up payment, too, but only if the IRS has your 2020 tax return. If the IRS based your payment on your 2019 tax return but your 2020 federal tax return shows you qualify for more money for that third payment, the IRS will send you the difference as a separate plus-up payment.

Reason No. 3: Getting your missing money from the first two stimulus checks

Your federal tax returns this year are also how you'll recover any money the IRS owes you from the first two stimulus checks. If you either didn't get a payment or got less than you were eligible to receive, you can claim that money on your federal tax forms as a rebate credit when you file this year. That goes for nonfilers, too -- those who aren't normally required to file a tax return. If you wait to file your taxes closer to a new, later due date, you're also waiting to receive your money, which will be bundled into your tax return.

Reason No. 4: Getting the right amount for your third stimulus check

The IRS uses information on your 2020 tax return, if it has it, to determine the amount you'd get in your third stimulus check. Specifically, the IRS looks at the AGI, or adjusted gross income, on your 2020 form to help figure out your payment by using a new stimulus check formula.

But the tax agency will use your 2019 return if your 2020 taxes haven't been accepted by the time your payment is sent. That could work in your favor if your income from 2019 was lower than your income from 2020. (You won't have to return the money in most cases.)

However, if your 2020 tax return would bring you a larger third stimulus check, like if you have more dependents, you'll want to file as soon as possible, so the IRS processes your 2020 taxes before releasing your third stimulus check. Here's what people who don't normally file taxes should know.

Is the May 17 deadline the same for my state's tax return?

This year, according to the Association of International Certified Professional Accountants, 37 states have shifted their deadlines. Check with your state's tax agency for the specific deadline.

Your taxes this year are also tied to your stimulus payment.

Sarah Tew/CNETWhat should I do if I can't make the Monday deadline?

If you need time beyond May 17 you can file a tax extension, which gives you more time to complete and send your paperwork to the IRS. The IRS said individual taxpayers don't need to file forms or call the IRS to qualify for the extension.

The new extension doesn't get you off the hook for estimated tax payments, however. The IRS said the May 17 deadline doesn't apply to those who make estimated payments, which were still due on April 15.

For more details on taxes this year, we spell out the difference between a tax refund and a tax return and how tax season is different in 2021.

from CNET https://ift.tt/2RcSDKp

via IFTTT

No comments:

Post a Comment