If you plan to request an extension, there are some things you should know.

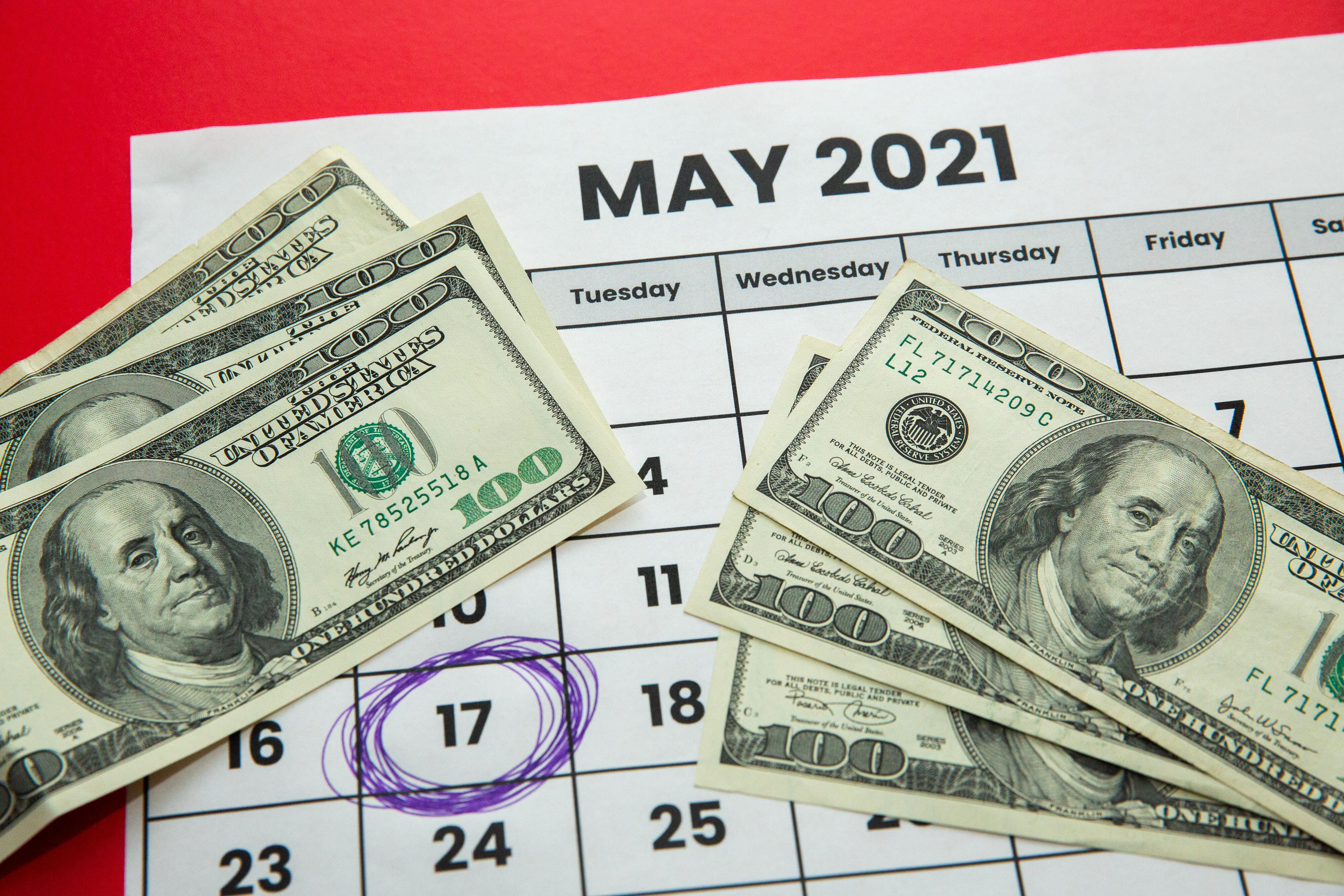

Sarah Tew/CNETWill you make the Tax Day deadline this year? It's May 17 -- just a few days away -- so if it looks like you're going to miss the deadline to file your tax return, you will want to consider filing a tax extension. The IRS doesn't even ask why you need more time to file.

If you request an extension, you'll have until Oct. 15 to file your taxes, but an extension doesn't get you off the hook from having to pay taxes you owe now. Also, an extension could delay your tax refund, a plus-up stimulus payment or money from the first and second stimulus checks you need to claim by filing this year. We'll explain more below.

After you file, it may take a little longer to get your tax refund, but tracking your combined refund and stimulus payment can help. We can also tell you about the new child tax credit payments, including how much you might get, as well as which families are eligible (including dependents). You can also read about what might be on the horizon with a fourth stimulus check. This story has been updated.

What to know if you file a tax extension with the IRS

If you think you're not going to make the May 17 deadline to file your taxes this year, you can file an extension with the IRS to move the date for filing your tax return to Oct. 15. You need to request the extension no later than May 17.

Extending your filing deadline to October doesn't delay when you have to pay taxes you may owe. You have to pay the estimated taxes you owe by May 17. Otherwise, you will accrue interest on what you owe, which you'll eventually have to pay -- plus other possible penalties -- on top of your income taxes.

If you're eligible for a plus-up stimulus payment, a tax extension could delay when you receive it

If the IRS calculated the amount of your third stimulus payment using your 2019 tax return, you could qualify for more money as a so-called "plus-up payment" once the IRS receives 2020 taxes and recalculates your total. However, until you file a 2020 tax return, the IRS won't have your new income or dependent information on file. If you file a tax extension, it will further delay your full payment.

You'll see a delay in claiming missing money from the first two stimulus checks if you get an extension

If the IRS owes you money from the first two stimulus checks -- maybe you didn't receive either check or received less than you qualified for -- you can claim the missing payments through a recovery rebate credit on your 2020 tax form. This holds even if you're not usually required to file taxes. So the longer you wait to file, the longer it'll take to get your missing stimulus payment.

May 17 is the deadline to file your income tax return or request an extension.

Sarah Tew/CNETNot filing till Oct. 15 could reduce your child tax credit payment amount this year

The IRS will use your 2020 tax return to determine how much money you qualify for as part of the expanded child tax credit this year. If you wait till October to file, the IRS may use an older tax return to calculate your payments. If a change in income or a new dependent is not reflected on that older return, you could get less money than you qualify for this year.

Your refund will be delayed if you file a tax extension

The timeline for getting your income tax refund -- or your refund plus outstanding stimulus money -- depends on when you file. While you have until Oct. 15 to submit your return if you've filed an extension, it doesn't mean you have to wait that long to file.

For example, if you file by the May 17 deadline, you could receive your money as soon as May 24. However, if you wait until Oct. 15, the earliest you would get money back is Oct. 22. The IRS is experiencing delays providing some services because of the pandemic, so in some situations, it could take longer to receive your money.

See our chart below for more details on when you can expect your tax refund, which will include your missing stimulus payment.

When to expect your tax refund

| If you file on this date | This is the soonest | This is the latest |

|---|---|---|

| May 17 (last day to file) | May 24 | June 7 |

| Oct. 15 (last day with extension) | Oct. 22 | Nov. 5 |

Filing a tax extension with the IRS in 2021: You have 3 options

Here are three ways the IRS says you can file a tax extension:

Option 1: Pay all or part of your estimated income tax due using Direct Pay, the Electronic Federal Tax Payment System, or using a debit or credit card, and note that you've filed for an extension.

Option 2: File Form 4868 (PDF) electronically by accessing IRS e-file using your tax software or by working with a tax professional that uses e-file. Make sure you have a copy of your 2019 tax return.

If you need to find a tax software service to use, and you make $72,000 or less, you can use the IRS Free File Online tool to find the an IRS-approved free filing service. You'll need to gather the following information: income statements (W2s or 1099s); any adjustments to your income; your current filing status (single, married, filing jointly); and dependent information. If you make more than $72,000, you can use the Free File Fillable form.

Once you enter all your information, the IRS will help determine which option is best for you -- for example, it could be the IRS Free File Program by TurboTax or TaxSlayer.

Option 3: File a paper Form 4868 and enclose payment of your estimate of tax due. Make sure it's postmarked on or before May 17.

For more tax information, we spell out the difference between a tax refund and a tax return, how tax season is different in 2021 and three reasons to sign up for direct deposit when you file your taxes.

from CNET https://ift.tt/3eIH7Pz

via IFTTT

No comments:

Post a Comment